Payroll Services

Payroll Services

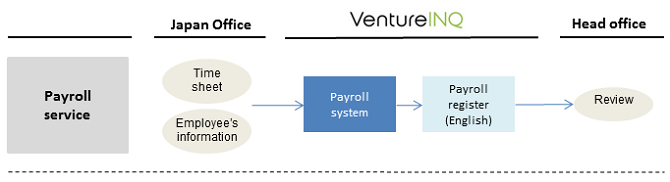

Our Payroll Services include maintenance of payroll allowances, deductions, and personal data required for all the Japanese social insurance and payroll tax requirements.

Payroll in Japan

As per the Japanese labor Act., companies need to pay exact salary to their employees in a timely manner at least one time per month . Upon failure to comply with this rule, companies will either be penalized or will be held responsible for an offense under the Labor Act. Therefore, preparing and dispensing salaries in time becomes all the more important for companies.

Some companies have a misconception that payroll process is easy to handle. Nevertheless, when the actual time of calculating precise employee salary and filing statutory contributions arrives, they understand the intricacy of the process. Additionally, the resources and infrastructure to run an in-house payroll process increases your operational costs and wastes valuable working hours. Thus, the best way to comply with the Labor Act and still enjoy the benefits of paying your employees on time is by outsourcing your payroll services to an accredited Japanese Payroll Service providing firm.

Social Insurance in Japan

Social insurance in Japan is comprised of Pension, Health, Unemployment and Worker’s Accident Compensation. All of employees working for Japanese company are required to pay these insurance premiums. Social insurance premiums are deducted from a salaried worker’s monthly salary. Pension and health premiums are calculated as a percentage of the ‘standard salary’. Standard salary is determined by taking the average compensation for three previous months. Unemployment and workers’ accident compensation insurances premiums are calculated as a percentage of the actual compensation instead of the standard salary.

Payroll

- Monthly payroll

- Preparation of pay slips with envelopes

- Bonus calculation

- Preparation of WH income tax statement

- Annual calculation for employment income (Year-end adjustment)

- Compilation of payroll lists for inhabitant taxes

- Legal record total table

Social insurance procedures

- Notification of base amount for the calculation of social insurance

- Yearly renewal procedures for labor insurance

- New application for social insurance

- New application for labor insurance

- Social insurance procedures for new employees

- Labor insurance procedures for new employees